Arkansas Lease Tax Rate . You will need to get a sales tax permit to collect and remit sales tax in every state where you are leasing or renting tangible. in the state of arkansas, any rentals lasting less than 30 days, requires a tax paid on the basis of rental payments to the lessor,. the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. the arkansas sales tax is 6.5% of the gross receipts from the sales of tangible personal property and certain selected services. But, when combined with local sales taxes, the rate can be as high as 11.625% in some. a complete listing of all cities and counties which levy a local sales and use tax with information listing the code for the. arkansas has a statewide sales tax rate of 6.5%.

from rentallease.com

a complete listing of all cities and counties which levy a local sales and use tax with information listing the code for the. the arkansas sales tax is 6.5% of the gross receipts from the sales of tangible personal property and certain selected services. You will need to get a sales tax permit to collect and remit sales tax in every state where you are leasing or renting tangible. arkansas has a statewide sales tax rate of 6.5%. the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. But, when combined with local sales taxes, the rate can be as high as 11.625% in some. in the state of arkansas, any rentals lasting less than 30 days, requires a tax paid on the basis of rental payments to the lessor,.

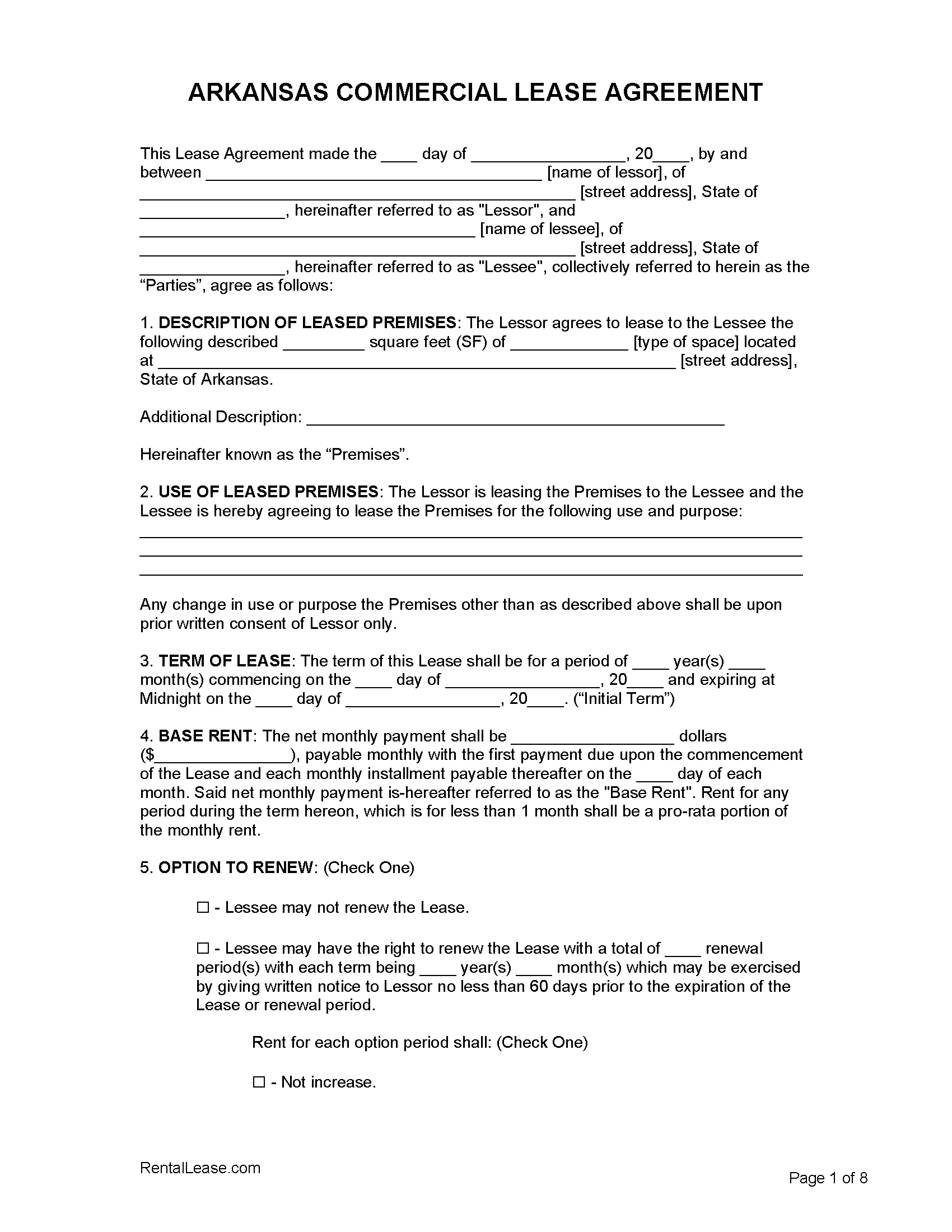

Arkansas Commercial Lease Agreement Template « Rental Lease Agreements

Arkansas Lease Tax Rate You will need to get a sales tax permit to collect and remit sales tax in every state where you are leasing or renting tangible. the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. the arkansas sales tax is 6.5% of the gross receipts from the sales of tangible personal property and certain selected services. a complete listing of all cities and counties which levy a local sales and use tax with information listing the code for the. But, when combined with local sales taxes, the rate can be as high as 11.625% in some. You will need to get a sales tax permit to collect and remit sales tax in every state where you are leasing or renting tangible. arkansas has a statewide sales tax rate of 6.5%. in the state of arkansas, any rentals lasting less than 30 days, requires a tax paid on the basis of rental payments to the lessor,.

From eforms.com

Free Arkansas Lease Agreements (6) Residential & Commercial PDF Arkansas Lease Tax Rate the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. You will need to get a sales tax permit to collect and remit sales tax in every state where you are leasing or renting tangible. arkansas has a statewide sales tax rate of 6.5%. the arkansas sales tax is. Arkansas Lease Tax Rate.

From www.mortgagerater.com

Arkansas Tax Rate Explained Clearly Arkansas Lease Tax Rate a complete listing of all cities and counties which levy a local sales and use tax with information listing the code for the. But, when combined with local sales taxes, the rate can be as high as 11.625% in some. the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and.. Arkansas Lease Tax Rate.

From www.uslegalforms.com

Arkansas Residential Rental Lease Agreement Arkansas Lease Agreement Arkansas Lease Tax Rate the arkansas sales tax is 6.5% of the gross receipts from the sales of tangible personal property and certain selected services. arkansas has a statewide sales tax rate of 6.5%. But, when combined with local sales taxes, the rate can be as high as 11.625% in some. in the state of arkansas, any rentals lasting less than. Arkansas Lease Tax Rate.

From printableformsfree.com

Ar Free Rental Printable Forms Printable Forms Free Online Arkansas Lease Tax Rate in the state of arkansas, any rentals lasting less than 30 days, requires a tax paid on the basis of rental payments to the lessor,. the arkansas sales tax is 6.5% of the gross receipts from the sales of tangible personal property and certain selected services. arkansas has a statewide sales tax rate of 6.5%. But, when. Arkansas Lease Tax Rate.

From www.cashreview.com

State Corporate Tax Rates and Brackets for 2023 CashReview Arkansas Lease Tax Rate in the state of arkansas, any rentals lasting less than 30 days, requires a tax paid on the basis of rental payments to the lessor,. the arkansas sales tax is 6.5% of the gross receipts from the sales of tangible personal property and certain selected services. arkansas has a statewide sales tax rate of 6.5%. You will. Arkansas Lease Tax Rate.

From legaltemplates.net

Free Arkansas Residential Lease Agreement Template PDF & Word Arkansas Lease Tax Rate You will need to get a sales tax permit to collect and remit sales tax in every state where you are leasing or renting tangible. But, when combined with local sales taxes, the rate can be as high as 11.625% in some. arkansas has a statewide sales tax rate of 6.5%. the arkansas sales and use tax section. Arkansas Lease Tax Rate.

From phaidrawtracy.pages.dev

Arkansas State Sales Tax Rate 2024 Kevyn Merilyn Arkansas Lease Tax Rate You will need to get a sales tax permit to collect and remit sales tax in every state where you are leasing or renting tangible. But, when combined with local sales taxes, the rate can be as high as 11.625% in some. arkansas has a statewide sales tax rate of 6.5%. the arkansas sales tax is 6.5% of. Arkansas Lease Tax Rate.

From freeforms.com

Free Arkansas Rental Lease Agreement Templates PDF WORD Arkansas Lease Tax Rate arkansas has a statewide sales tax rate of 6.5%. a complete listing of all cities and counties which levy a local sales and use tax with information listing the code for the. You will need to get a sales tax permit to collect and remit sales tax in every state where you are leasing or renting tangible. . Arkansas Lease Tax Rate.

From rentallease.com

Arkansas Commercial Lease Agreement Template « Rental Lease Agreements Arkansas Lease Tax Rate arkansas has a statewide sales tax rate of 6.5%. a complete listing of all cities and counties which levy a local sales and use tax with information listing the code for the. You will need to get a sales tax permit to collect and remit sales tax in every state where you are leasing or renting tangible. . Arkansas Lease Tax Rate.

From deeynyengracia.pages.dev

Arkansas Sales Tax Free Weekend 2024 Nadya Valaria Arkansas Lease Tax Rate in the state of arkansas, any rentals lasting less than 30 days, requires a tax paid on the basis of rental payments to the lessor,. You will need to get a sales tax permit to collect and remit sales tax in every state where you are leasing or renting tangible. the arkansas sales and use tax section administers. Arkansas Lease Tax Rate.

From www.mortgagerater.com

Arkansas Tax Rate Explained Clearly Arkansas Lease Tax Rate But, when combined with local sales taxes, the rate can be as high as 11.625% in some. You will need to get a sales tax permit to collect and remit sales tax in every state where you are leasing or renting tangible. a complete listing of all cities and counties which levy a local sales and use tax with. Arkansas Lease Tax Rate.

From eforms.com

Free Arkansas RenttoOwn Lease Agreement PDF Word eForms Arkansas Lease Tax Rate arkansas has a statewide sales tax rate of 6.5%. in the state of arkansas, any rentals lasting less than 30 days, requires a tax paid on the basis of rental payments to the lessor,. the arkansas sales tax is 6.5% of the gross receipts from the sales of tangible personal property and certain selected services. You will. Arkansas Lease Tax Rate.

From exoffbmks.blob.core.windows.net

Helena Arkansas Sales Tax Rate at William Naples blog Arkansas Lease Tax Rate But, when combined with local sales taxes, the rate can be as high as 11.625% in some. arkansas has a statewide sales tax rate of 6.5%. You will need to get a sales tax permit to collect and remit sales tax in every state where you are leasing or renting tangible. the arkansas sales tax is 6.5% of. Arkansas Lease Tax Rate.

From rentallease.com

Free Arkansas Rental Lease Agreement Templates PDF Word Arkansas Lease Tax Rate a complete listing of all cities and counties which levy a local sales and use tax with information listing the code for the. You will need to get a sales tax permit to collect and remit sales tax in every state where you are leasing or renting tangible. in the state of arkansas, any rentals lasting less than. Arkansas Lease Tax Rate.

From gis.arkansas.gov

Arkansas Sales and Use Tax Rates April 2018 Arkansas GIS Office Arkansas Lease Tax Rate the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. in the state of arkansas, any rentals lasting less than 30 days, requires a tax paid on the basis of rental payments to the lessor,. the arkansas sales tax is 6.5% of the gross receipts from the sales of. Arkansas Lease Tax Rate.

From www.templateroller.com

Arkansas Farm Lease Agreement Template Fill Out, Sign Online and Arkansas Lease Tax Rate arkansas has a statewide sales tax rate of 6.5%. You will need to get a sales tax permit to collect and remit sales tax in every state where you are leasing or renting tangible. a complete listing of all cities and counties which levy a local sales and use tax with information listing the code for the. But,. Arkansas Lease Tax Rate.

From exoffbmks.blob.core.windows.net

Helena Arkansas Sales Tax Rate at William Naples blog Arkansas Lease Tax Rate arkansas has a statewide sales tax rate of 6.5%. in the state of arkansas, any rentals lasting less than 30 days, requires a tax paid on the basis of rental payments to the lessor,. But, when combined with local sales taxes, the rate can be as high as 11.625% in some. a complete listing of all cities. Arkansas Lease Tax Rate.

From www.financestrategists.com

Lease Rates Definition, Types, Factors, & Implications Arkansas Lease Tax Rate You will need to get a sales tax permit to collect and remit sales tax in every state where you are leasing or renting tangible. arkansas has a statewide sales tax rate of 6.5%. in the state of arkansas, any rentals lasting less than 30 days, requires a tax paid on the basis of rental payments to the. Arkansas Lease Tax Rate.